Navexa Blog

Ideas & resources on investing, financial literacy & fintech.

Oct 30, 2023Navexa 3.0: A New Breed Of Portfolio Tracker

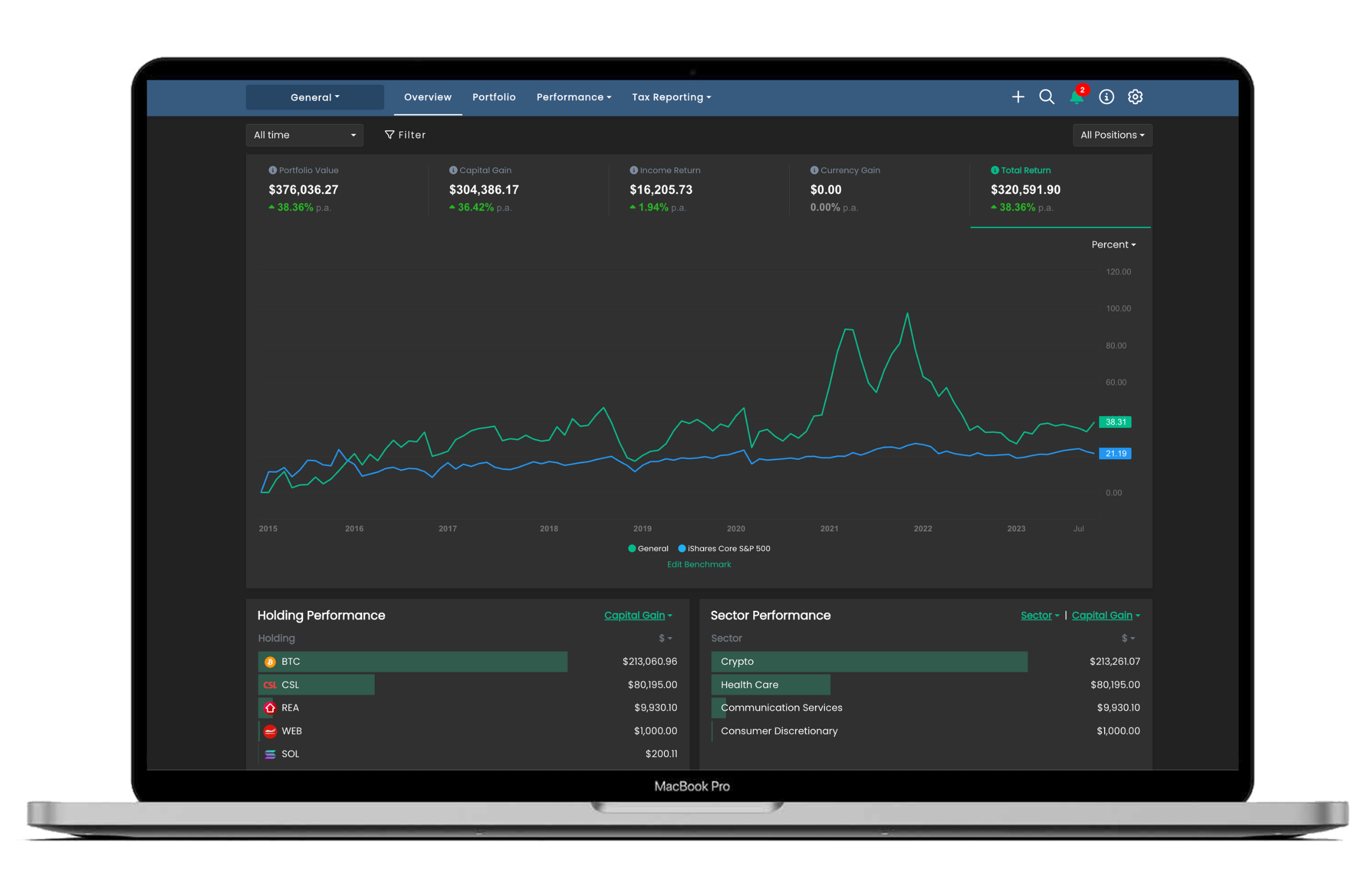

In this post, we explain why Navexa 3.0 is the our most advanced portfolio tracker update, and walk you through a few of the powerful new tools we’ve created to make understanding and optimizing your investments easier than ever before.

Feb 22, 2023Yahoo Finance vs Navexa: Portfolio Trackers Comparison

Modern portfolio management tools provide a snapshot of your investment returns, which include annualized capital gains, dividend payouts, and brokerage fees.

Nov 1, 2022How to Calculate Dividend Yield

Dividend yield is what companies pay their shareholders as both reward and incentive. We explain dividend yields and how to calculate them.

Oct 5, 2022Sixteen Of The Best Investing & Personal Finance Blogs & Podcasts

We profile 16 of the best investing, personal finance blogs and podcasts (and YouTube channels) you’ll find on the web in 2022.

Sep 15, 202211 Key Stock Market Sectors For Investors

Different market sectors offer unique opportunity and risk for investors, as well as a way to diversify a portfolio. These are the 11 key market sectors, and the pros and cons of each.

Sep 1, 2022Tax Implications For Australians Investing in Foreign Stocks

Foreign investment taxes can be complex. Generally, investors will pay capital gains tax or income tax, depending on the conditions. Here’s how to deal with Australian taxation on foreign investments.

Aug 23, 2022How to Calculate Total Stock Return

Total Stock Return is an investment performance metric that measures capital gains & income together. Here’s how to calculate it, use it, pros & cons, and more.

Aug 18, 20228 Portfolio Performance Metrics Investors Should Understand

Measuring portfolio performance can seem like a complex, dark art. We introduce eight powerful portfolio performance metrics for better understanding investments.

Aug 10, 2022How to Use the Discounted Cash Flow Model to Value A Stock

The discounted cash flow (DCF) method can help you calculate the current value of an investment. DCF can be used to value companies, stocks, and bonds.