Navexa Blog

Ideas & resources on investing, financial literacy & fintech.

Jun 5, 2024Understanding Australian Investment Taxes for Stocks

Investing in stocks is a popular way to build wealth. However, navigating the tax implications associated with stock investments can be daunting. This guide explains the key tax implications associated with stock investments in Australia. Why Understanding Investment Taxes is Crucial Taxes on investments can significantly impact overall returns. Knowing the specific tax obligations and […]

Jun 5, 2024Investment Income Tax on Stocks in Australia

Investing in stocks not only offers the potential for capital gains, but can also provide ongoing income in the form of dividends and distributions. However, like all income, these earnings are subject to taxation. Understanding the tax implications of your investment income is essential for maximizing your returns and ensuring compliance with Australian tax laws. […]

Jun 5, 2024Explained: Capital Gains Tax (CGT) on Stocks in Australia

If you invest in stocks, understanding the tax implications is crucial for optimizing your returns. One of the most significant taxes you’ll encounter is the Capital Gains Tax (CGT). This tax is applied to the profit you make when you sell your stocks for more than what you paid for them. This article breaks down […]

Jun 5, 2024The First In First Out Strategy (FIFO)

The FIFO strategy is the most common way of calculating capital gains. It is often the default method used by accountants and people reporting their own taxes. The strategy is simple. When calculating the capital gain, you process trades in order of the date you bought them. The first share parcel bought = the first […]

Jun 5, 2024The Minimize Gain Tax Strategy

The Minimize Gain strategy is a way of calculating capital gains. It is used when people are trying to minimize their capital gain. The strategy is simple. When calculating the capital gain, you process trades in order ofthe price you bought them for, with the highest price parcel coming first. Let’s look at an example […]

Jun 5, 2024The Last In First Out Strategy (LIFO)

The LIFO strategy is a way of calculating capital gains. It is used when people are trying to minimize their capital gain. This is because, usually, the last shares you bought will have a price that is closest to what you are selling them for. The strategy is simple, when calculating the capital gain, you […]

Jun 5, 2024The Maximize Gain Tax Strategy

The Maximize Gain strategy is a method of calculating capital gains. It is used when investors are trying to maximize their capital gain. The strategy is simple. When calculating the capital gain, you process trades in order of the price you bought them for, with the lowest price parcel coming first. An example of Maximize […]

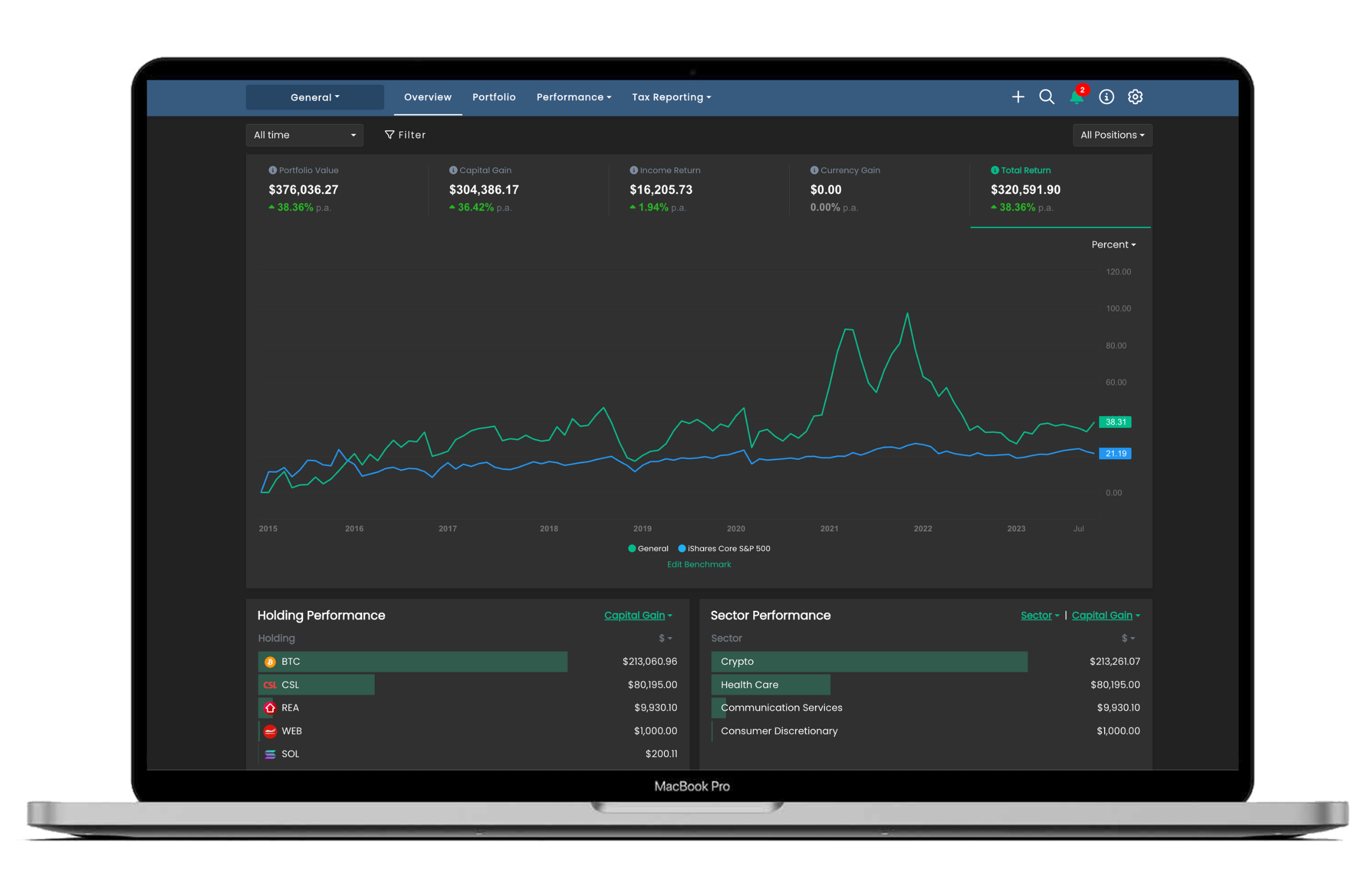

Oct 30, 2023Navexa 3.0: A New Breed Of Portfolio Tracker

In this post, we explain why Navexa 3.0 is the our most advanced portfolio tracker update, and walk you through a few of the powerful new tools we’ve created to make understanding and optimizing your investments easier than ever before.

Feb 22, 2023Yahoo Finance vs Navexa: Portfolio Trackers Comparison

Modern portfolio management tools provide a snapshot of your investment returns, which include annualized capital gains, dividend payouts, and brokerage fees.