Foreign investment taxes can be complex. Generally, investors will pay capital gains tax or income tax, depending on the conditions. Here’s how to deal with Australian taxation on foreign investments.

Many Australians want to know how and where to invest in foreign stocks, property, bonds and other investments. This means they need to understand the tax implications of doing so. Australian taxation rules might seem complex when it comes to investing in foreign stocks.

The Australian government has signed many tax treaties. These provide benefits to Australian residents who invest in foreign stocks in countries that have tax treaties with Australia. Such treaties sometimes mean Australian residents may be exempt from paying tax. However, they may have to pay it in the foreign country.

If there’s no tax treaty, Australian residents may have to pay tax on every type of investment gain. Some might be eligible for a discount, depending on how long they have held the investment.

Generally speaking, foreign investments are taxable, be it in the source country or Australia. If you’re an investor, you’ll most likely pay capital gains tax or income tax. Keep reading to learn about Australian tax on foreign investments and how easy it is to track them using the Navexa portfolio tracker.

Overseas Investing From Australia

Australian residents are free to invest in foreign assets. They can own overseas property, offshore bank accounts, businesses, and stocks. Owning foreign investments requires that Australians comply with the latest rules and regulations regarding tax.

Interacting with the Australian Tax System

Every Australian resident is subject to tax on their income. This includes investment income such as dividends as well as capital gains from foreign investments. However, the Australian government has signed more than 40 tax treaties with other countries, including the US.

The US-Australia tax treaty gives Australian investors certain benefits. For example, there’s a reduced tax rate for US-sourced income (dividend payments) if certain conditions occur. Investors can also fill out specific forms that drop the rate of withheld tax from 30% to 15%. But, they may have to pay taxes in the US.

Australian investors might be able to claim US withholding tax from their dividends as a Foreign Income Tax Offset (FITO). FITO helps reduce taxes on foreign earnings.

But FITO rules are complex. It may be useful to seek professional guidance around this. Both the Inland Revenue Service (IRS) and US tax advisors can provide in-depth information for individual situations.

W-8BEN-E: A Key Form For Foreign Investors

The US government requires Australian investors fill out certain forms when investing in the country. A W-8BEN-E is a common form. It determines which investors are subject to paying 30% of their gross income earned in the US to the IRS. This form defines:

- Interest

- Royalties

- Annuities

- Rent

- Premiums

- Compensation for services

- Substitute payments, if applicable

It’s required for all US holdings and remains valid for three years. If your information changes, you’ll be required to submit an update.

Do Australian Residents Pay Tax on Gains and Income from Foreign Investments?

Australian residents for tax purposes have to declare the income they earn regardless of where that income came from. This is called the ‘worldwide income’ and it includes:

- Pensions

- Annuities

- Business activities

- Employment

- Assets

- Investments

- Dividends from shares

- Capital gains on overseas assets

- Interest from bank deposits or bonds

- Rental income from real estates

- Royalties from intellectual property

If you have a temporary resident visa, you won’t pay tax on income. In case you receive income from a country that hasn’t signed a tax treaty with Australia, you’ll likely pay taxes in both countries. However, the tax you pay in a foreign country may make you eligible for FITO.

Australia also receives and exchanges information on all financial accounts with many foreign tax authorities.

How Is Foreign Investment Taxed?

Australian investors who have foreign assets and receive income from overseas will usually have to pay capital gains tax once they sell that asset. However, there could be other forms of taxes they are required to file (such as income from dividends). This is why it’s important to keep all the records on transactions, regardless of the country in which you invest.

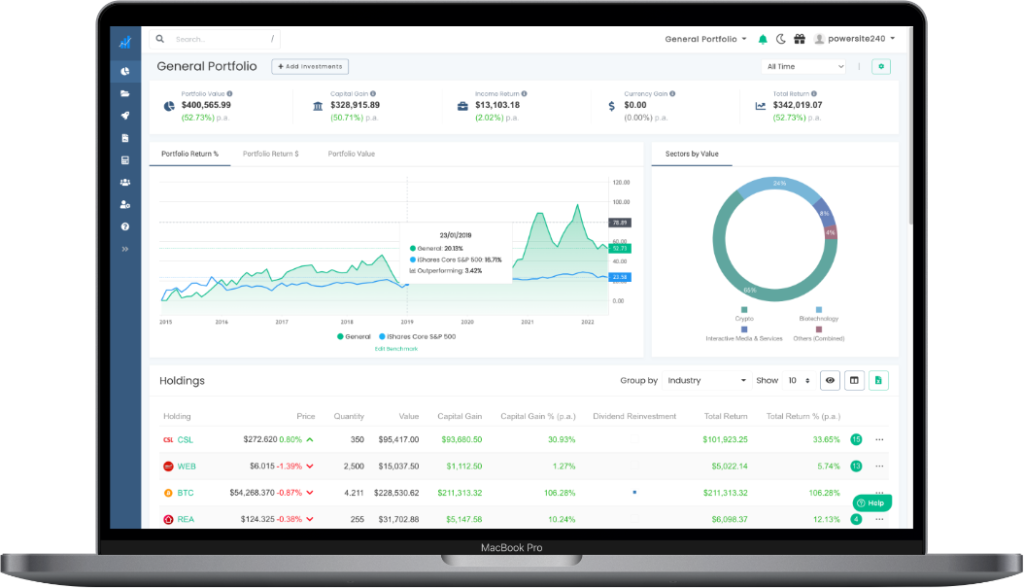

Here’s where Navexa makes life easier. Our smart portfolio tracker lets you track foreign investments in both their local currency, and your tax residency’s currency, too.

This makes it super simple to monitor the performance of your foreign shares and keep records of all transactions for tax and compliance purposes.

Types of Investments and Their Taxation

Australian investors have access to several investment opportunities abroad. These are the most common ones.

Buying & Selling Stocks

Australians can own foreign stocks. Any individual who holds shares for more than 12 months may be eligible for the CGT discount. If they make a gain when they sell, Australian investors are required to notify the Australian Taxation Office. Investors are also advised to consult with the foreign tax authority to check the taxation process on capital gains.

Receiving Dividends From Foreign Investments

The way dividends are taxed depends on the tax treaty between Australia and the source country. In many cases, the source-country dividend tax is limited to 15%. Receiving dividends from companies that satisfy certain public listing requirements may result in tax exemption.

Depending on the conditions, some investors may be eligible for ‘franking credits’. That’s a form of tax credit that can offset against tax on dividends. Generally speaking, those who hold shares for a certain holding period (45 or 90 days) may be eligible.

Cryptocurrencies

In recent years, cryptocurrencies have become a major investment theme for Australian residents. When it comes to paying tax, Australian investors have to pay capital gains tax on crypto. On the other hand, professional traders pay income tax.

P2P Lending

Peer-to-peer (P2P) lending is a form of investment that’s accessible globally. Australians can access P2P lending platforms and lend money to borrowers without an intermediary. Peer-to-peer lending income listed in an investor’s loan portfolio will be included in the tax return form. For most people, this income is taxed like income from other investments. Australians who earn via P2P lending in foreign countries should consult their accountant.

Property Income

Australians who realize a gain when they sell foreign property are required to pay capital gains tax. However, if they held the property for 12 months or longer, they might be eligible for a 50% capital gains tax discount.

Additionally, investors who are subject to an overseas tax after selling their property will receive tax credits in the form of a foreign tax offset. Rental income may also be taxable in Australia or a foreign country, depending on the location of the property and current tax treaties.

Purchasing Bonds

Bonds can be highly tax efficient, since there are some benefits for those who hold them for 10 years. Otherwise, bonds are subject to the corporate tax rate of 30%. Investing in bonds means investors might not be eligible for tax credits and some other benefits.

Foreign Investment Capital Losses

Investors may sell a foreign investment for a lower price, and end up with a capital loss. In some cases, investors can use capital losses to reduce capital gains tax. Capital losses must be used at the first opportunity, unless there are restrictions. Capital losses can’t be used to reduce income, and should be reported to ATO just like capital gains.

Foreign Investments: Track Everything Correctly

If you’re an Australian resident for tax purposes, you’ll be required to pay some form of Australian tax on foreign investments.

In general, all your worldwide income will be subject to tax, it’s just a matter of where you pay that tax. It’s always a smart idea to get familiar with the laws around this, and to consult professionals regarding your personal financial situation.

Further to this, serious investors should always track their transactions and portfolio performance for the purposes of both compliance and optimizing their investment strategy.

The Navexa portfolio tracker does exactly this. Track Australian and overseas investments, access detailed performance analytics on income, currency, trading fees and more.

And, most importantly, ensure your foreign investment gains and income are reported accurately at tax time.

Sign up to Navexa now for a free 14-day trial to see how easy tracking and reporting on foreign investments can be!