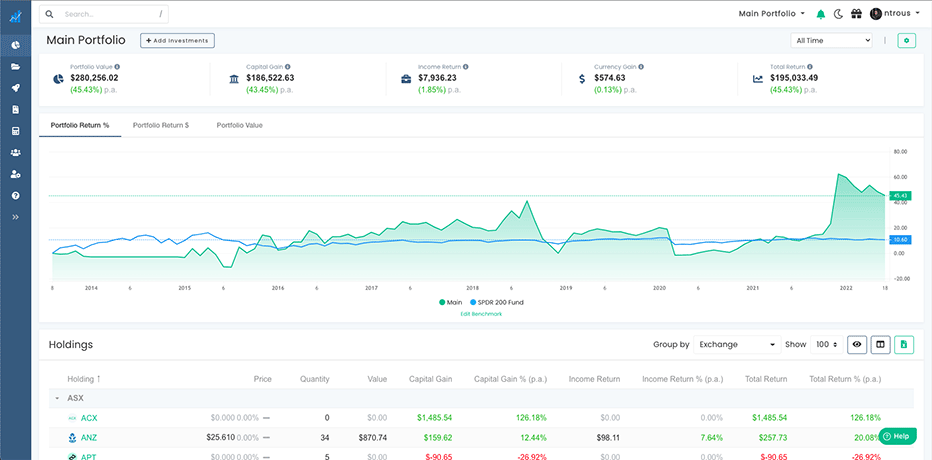

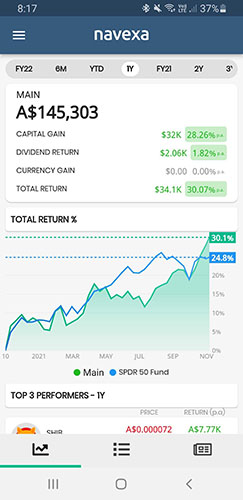

Automated Investment Tax Reporting & Optimization

Tax-Effective, Cost-Effective Reporting For All Your Investments In A Single Account

Which Tax Reporting Tasks Does Navexa Automate?

Long & short-term capital gains

Navexa calculates which gains do and do not qualify for Australia’s CGT discount of 50%.

Capital losses

Your account calculates any capital losses you realize when you sell an investment.

CGT concession amount

Navexa calculates the CGT concession amount for eligible long-term gains.

Dividend income

Track dividend payments (including reinvested dividends) for tax reporting purposes.

Income from partnerships and trusts

Navexa calculates all trust and partnership income for your portfolio.

Income from foreign sources

Your Navexa account also tracks and calculates foreign sourced income.

How Does Navexa Benefit Me At Tax Time?

Save Time

Navexa crushes tax calculation and reporting for stocks and crypto down to a single click.

Slash Tax Admin Costs

Save on accounting fees by automating your reporting.

Total Tax Control

Set tax strategies (FIFO, LIFO, Minimize & Maximize Gain) for your investments.

Calculate Everything Together

Bring all your investment tax reporting into one account for greater control.

Predict Capital Gains Tax

Navexa’s prediction tools show your investments' theoretical gains or losses.

Share With Your Accountant

Share access to your portfolios and download tax reports with ease.

Save On Time, Money and Taxes

Navexa automatically calculates your tax obligations based on your trading activity. Plus, our CGT and taxable income tools give you effortless control over how you calculate and report your gains and losses.

Get Started Free

Full CGT & Taxable Income Reporting

Navexa offers automated tax calculation and reporting tools for both capital gains and taxable income. This includes not just gains and losses, but discountable and non-discountable gains, reinvested dividends and more.

Get Started Free

Optimize Crypto & Stock Tax Together

Calculating and reporting on your stock and crypto investments together gives you a key advantage; you can apply losses in one asset to gains in another one, and vice versa.

Get Started Free