You have two main options for exposing your capital to the stock market: Direct and portfolio investment. Which suits investors best depends on a variety of factors. Let’s take a look at the case for direct versus portfolio investment.

Should you buy a stock, or buy an exchange-traded fund? In other words, should you buy shares in a single company, or buy shares in many companies, to generate the best return?

It’s a question that divides investors and analysts alike, largely because the answer depends on the individual’s objectives and risk tolerance.

In my eight years’ investing experience, I’ve opted exclusively for stocks instead of funds. That’s because I prefer to research companies directly. It just suits me to invest directly, too.

And that’s not to say I have anything against ETFs or ‘portfolio investing’. As you’ll see in this post, each method has its own merits and potential drawbacks.

Buying Individual Stocks vs. Buying Shares In A Fund

When you buy shares in an individual stock, you’re tying your capital to the fortune — or misfortune — of a single company. You’re not investing on the basis that the wider market, or the sector in which your stock operates, is going to rise.

You’re betting that this single company is going to outperform its competition and ultimately beat the market’s returns. On the other hand, when you buy shares in an ETF, you’re buying a sector, or bundle of stocks that share a common property.

This ties your capital to what happens to the group as a whole, not the performance of a single company.

We sometimes refer to this as ‘portfolio investing’, since you are in effect buying a slice of a pre defined portfolio of equities , rather than directly buying stocks for your own portfolio.

The Advantages Of Direct Investment Into Stocks

I’m biased here, because as I said, I have invested exclusively in individual companies as opposed to ETFs or portfolio investments. But, I am going to cover the advantages and disadvantages of both.

Please bear in mind, that this is general information on this topic and it does not constitute financial advice. Each of us has our own unique set of preferences, goals and challenges.

So I encourage you to do your own research and seek professional advice before you make any investment decisions one way or the other.

So, to direct investment in stocks.

Here’s the biggest advantage: If you’re a keen and diligent investor who’s not afraid of putting in the hard yards to research and value individual stocks, you may be able to generate a higher return than just parking your money in an ETF.

Each company trading in the market has an extensive set of factors driving its stock price at any given time. It could be a new technology or product, an acquisition or deal, a piece of legislation that impacts the business… whatever it is, events often impact certain stocks in certain ways.

If your research leads you to one of these opportunities — say, a biotech stock trialling a revolutionary treatment that could save millions of lives, for instance — then direct investment into that one stock could potentially make you more money than an ETF than contains that stock in its portfolio.

The Disadvantages Of Direct Investment Into Stocks

As we pointed out in our blog on the pros and cons of dividend reinvestment policies, concentrated exposure of capital to a particular investment brings as much risk as it does potential reward.

If you’re the type of investor who puts in the research to find and buy great stocks that deliver strong returns, then direct investment could be a profitable strategy for you.

However, no amount of research will change the fact that buying shares in a single company means you expose your capital to its stock’s potential to rise and fall.

The old ‘eggs in baskets’ analogy is useful here. Buying a single stock as opposed to buying a portfolio of stocks in the form of an ETF is akin to putting your eggs in one basket.

It’s a question of risk.

Just as a particular company can outperform a sector or market, so can it underperform and drop in price even when other, similar stocks are performing relatively well.

Diversification is perhaps the most common idea when we talk about managing and mitigating risk in an investment portfolio.

Direct investment in one stock is about as far from diversified as you can get, whereas ETFs are created by professional portfolio managers to whom diversification and risk management are often their primary objective.

KEY TAKEAWAYS

- Expose your capital to the exact stocks and companies you choose.

- Requires more independent research.

- Potential for high returns if the individual companies you invest in outperform the market.

- Investing in just a few stocks may compromise your portfolio’s diversification.

- Risk of lower returns if individual companies you invest in underperform their sector or the wider market.

The Advantages Of Investing In A Portfolio or ETF

I don’t personally invest in ETFs. And I’m certainly not advising whether direct or indirect investment is best for you.

The idea of indirect investment in markets or sectors through ETFs is a valid and increasingly popular one today. Many of us know we need to be exposed to the stock market in order to build out wealth over the long term.

But, equally, many of us don’t have the time to put in the long hours of research and analysis to find the particular stocks that might suit our goals.

An ETF is like a mini-portfolio of investments. Depending on what’s in the ETF, it may offer investors some risk-management in the form of diversification.

For example, if you bought a biotechnology ETF comprised of, say, 100 companies, you’d get exposure to that sector and the performance of all the equities in the fund.

The fund might include assets that hedge against risks to the biotechnology sector. This indirect way of getting exposure to these companies might then come with less risk than picking and investing in a single one.

Also, when you consider the time and energy it takes to research, execute and monitor investments, indirect investment in an ETF can alleviate some of the burden that comes with direct investing.

If you want to gain exposure to biotech stocks and you simply don’t have the time to dive in to all the research on the various companies and factors in their performance, you could opt to buy a fund that broadly, indirectly exposes you instead.

The Disadvantages Of Portfolio Investing

As with direct investment in individual stocks, ETF, or portfolio investing, comes with potential downsides, too.

I’m not saying these apply to every ETF out there, but the following points you may want to consider when weighing up direct versus indirect investment.

- An ETF may not be as diversified as you’d like: With stability and risk management high on the list of fund managers’ concerns, ETFs may skew towards large and mid-cap companies. This might mean you miss exposure to potentially high-growth small cap stocks in the sector.

- You may pay higher investment fees: When you buy a single stock, you’ll pay a brokerage fee. When you buy shares in an ETF, you’ll pay a brokerage fee and a management fee — usually as a percentage of your investment’s returns — to the people running the fund.

- Your dividend yields may be lower: Because ETFs by design track a broader market or sector, they generally don’t prioritise yield. Having said that, there are some funds out there that focus more on income than capital gain.

The sheer variety of stocks and funds out there means these pros and cons certainly don’t apply across the board. And remember, it’s important to do your own research and consider your goals and risk tolerance.

KEY TAKEAWAYS

- Quicker way to get exposure to an entire sector or market.

- Allows you to effectively outsource the research to the fund managers.

- Gives you more diversification because one share of an ETF exposes you to the portfolio of the fund’s investments.

- Potentially higher investment and management fees.

- Potentially lower dividend yields.

My Personal Preference: Direct Investment In Stocks I Know Well

As I’ve said, I don’t buy ETFS.

I’ve never bought shares in anything other than individual stocks. Why? Because, in the same way some of us prefer to drive a manual car over an automatic, I prefer having a greater degree of control over my investments.

That’s not to say that because I prefer stocks I am more in control of my returns. But, in my experience, I am more in control of the assets to which my capital is exposed by being in the market.

Research, for me, isn’t a chore. I enjoy digging into a company’s price movement, financials and business model to uncover investment opportunities I believe are going to make me great long-term returns.

Direct investment means I can control every aspect of my portfolio’s composition, diversification, the extent to which I’m targeting income versus capital gains, and so forth.

While there may come a time when indirect investment suits my needs, right now I prefer to have my portfolio in my own hands — not the hands of fund managers.

However You Prefer To Invest, You Must Track Your Performance

I hope you now grasp some of the pros and cons of both direct and indirect investment. Like I say, it’s really up to you how much diversification you seek and risk you take on.

Your financial objectives and challenges are no doubt different from my own.

But, whether you prefer investing in single stocks, or the broader exposure you can get by indirectly owning large groups of stocks through an ETF, there’s one thing you absolutely should start doing.

If you don’t do this already, you may not have a clear picture of how your investments are performing for you. What am I talking about?

Tracking your true portfolio performance.

Over my eight years as a self-directed investor, and more recently launching a dedicated portfolio tracking platform, I’ve learned that far too many people ignore crucial facts about their investment performance.

One of the main reasons for this is, in my opinion, the average broker doesn’t provide sufficient detail for you to accurately measure and analyse your portfolio.

For instance, if I tell you that a single stock investment and an ETF investment have produced the same return, say 100%, would you say there’s nothing to choose between them?

Looking at the average broker account, it might seem that way, since most display a simple ‘gain’ metric.

But what if I told you that the stock took a year to return that 100% and the ETF took three?

You’d see that the stock was the better option, right? So, if you’re serious about generating great returns for yourself over the long term, I encourage you to look beyond just ‘gains’.

Three Tools I Use To Better Understand My Returns

(And, Hopefully, Make Better Investing Decisions)

As a dedicated portfolio tracker, Navexa gives me insights into my portfolio performance I simply cannot get through my broker. Here are three tools I use to better understand portfolio.

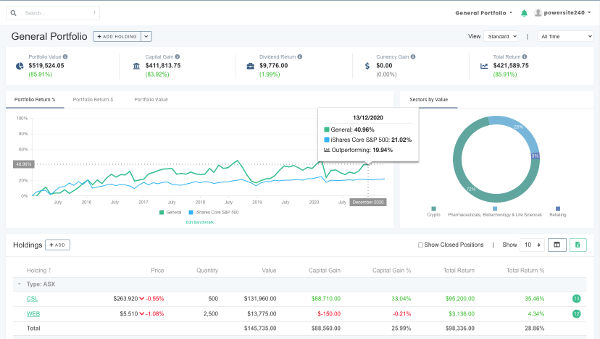

Annualized Returns: Navexa’s performance calculation factors in everything that affects my portfolio. Time, taxation, trading fees, dividend income, currency gain and losses — everything that impacts what I would exit the trade with when all is said and done. When I look at my portfolio in my account, I know I’m seeing my true performance.

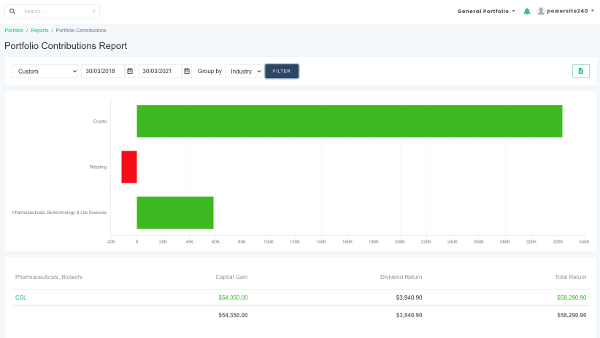

Portfolio Contributions: This reporting tool shows me which holdings are boosting, and which are dragging down, my overall returns. This helps me to make decisions on which stocks to sell and keep.

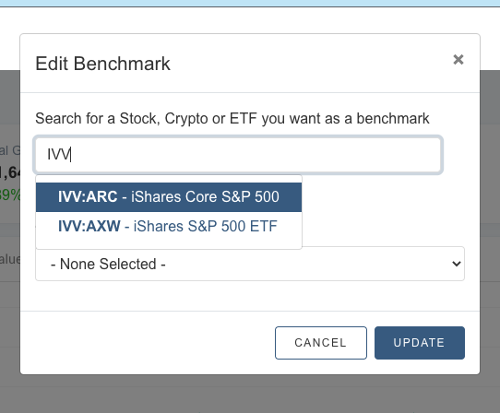

Custom Benchmarking: This one is especially useful if you’re comparing your portfolio against an ETF. If you have a portfolio of individual stocks, like I do, and you see that a given ETF (Navexa lets you benchmark against any security or fund traded on the ASX, NYSE or NASDAQ) is outperforming your portfolio, you might consider switching up your strategy!

I hope this post has helped you understand some of the differences between direct and indirect investment. Remember, you’re on your own investing journey — none of the above is financial advice.

Whether you directly invest in stocks, or you opt for a portfolio investing strategy through ETFs, always remember you’re risking your capital in the stock market.

Risk is the price we pay for the chance to earn better returns than leaving our money in the bank.

And the elevated risk levels I live with as a self-directed investor are a big part of why I founded Navexa.